With electric vehicles (EVs) rapidly gaining popularity across Europe, many drivers are discovering that insuring these vehicles comes with unique considerations. Whether you own an electric car, are considering purchasing one, or are simply curious about the future of auto insurance, understanding the special factors that impact EV insurance is increasingly important. This guide explores how electric and hybrid vehicle insurance differs from conventional coverage across European markets.

The EV Revolution in Europe

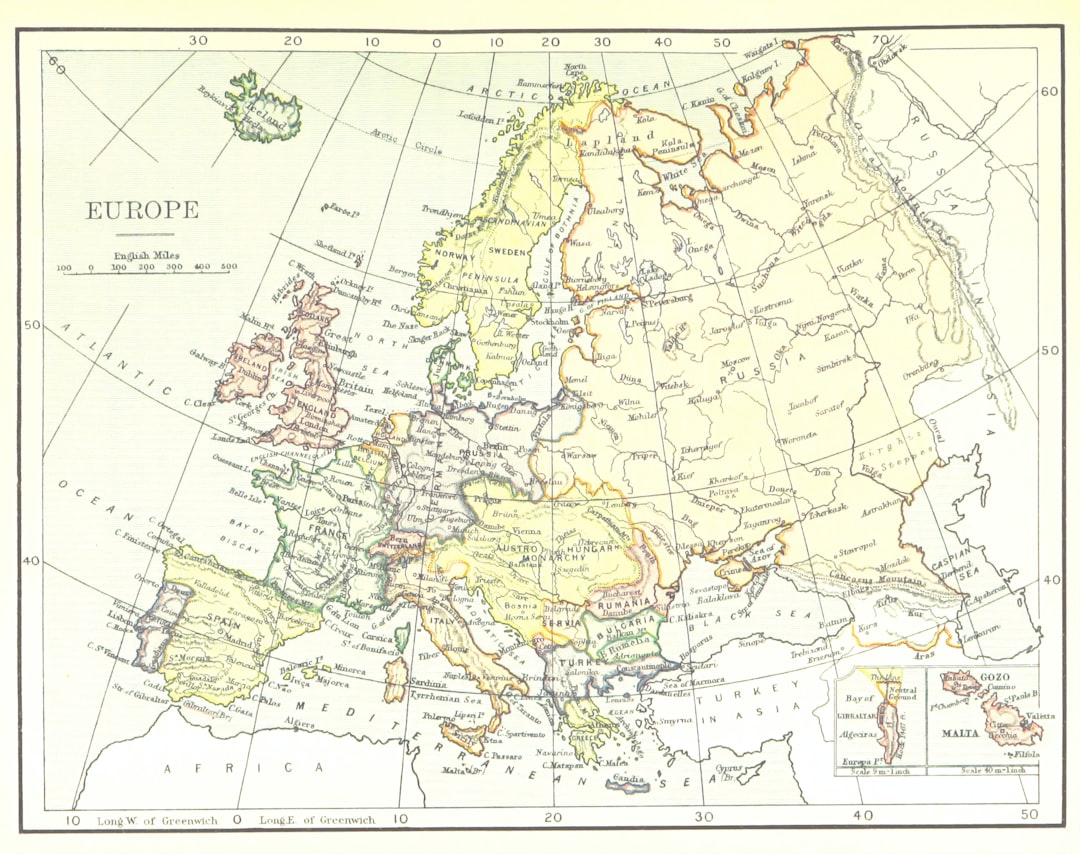

Europe has emerged as a global leader in electric vehicle adoption, with several countries seeing dramatic growth in EV market share:

- Norway leads with over 80% of new car sales being electric or plug-in hybrid vehicles

- The Netherlands, Sweden, and Denmark have all seen rapid EV adoption

- Countries like France, Germany, and the UK are investing heavily in charging infrastructure and offering incentives for EV purchases

With this surge in electric mobility comes a need for insurance products that address the unique characteristics of these vehicles. But how exactly does insuring an EV differ from insuring a conventional internal combustion engine (ICE) vehicle?

Key Differences in EV Insurance

1. Higher Vehicle Value

Electric vehicles typically have higher purchase prices than comparable conventional models, which directly impacts insurance premiums. This price difference stems from:

- Battery costs: The lithium-ion battery packs in EVs represent a significant portion of the vehicle's value

- Advanced technology: EVs often come with cutting-edge electronics, software, and driver assistance features

- Limited scale: Though improving, production economies of scale haven't yet reached the level of conventional vehicles

As a result, the replacement value that insurers must cover is typically higher, leading to higher premiums in many cases. However, this gap is narrowing as EV production increases and technology costs decrease.

2. Battery-Specific Coverage

The battery is the most expensive component in an electric vehicle, often accounting for 30-40% of the total vehicle cost. This creates several insurance considerations:

Battery Damage Coverage

Specialized EV insurance policies often include specific provisions for battery damage, addressing concerns such as:

- Damage from overcharging or charging station malfunctions

- Battery leakage or fire risks

- Gradual degradation vs. sudden failure

Battery Leasing Considerations

Some EV manufacturers, particularly Renault in Europe, offer battery leasing arrangements separate from the vehicle purchase. This creates a unique insurance situation where:

- The battery might be insured by the leasing company

- Your policy needs to reflect the correct ownership arrangement

- Liability may be divided between multiple parties in case of battery-related incidents

3. Charging Equipment Coverage

Home charging equipment represents another aspect of EV ownership that requires insurance consideration. Many EV-specific policies now offer coverage for:

- Wall-mounted charging units (wallboxes) installed at home

- Portable charging cables that could be damaged or stolen

- Liability coverage for charging-related incidents (such as someone tripping over your charging cable)

Some home insurance policies may cover permanently installed charging equipment, but portable equipment often requires specific coverage either through your auto policy or as a separate rider.

4. Specialized Repair Considerations

Electric vehicles require specialized technicians and repair facilities, which can impact insurance in several ways:

Limited Repair Networks

Not all repair shops can service EVs, which means:

- Insurers may have a more limited network of approved repair facilities

- Wait times for repairs could be longer

- Some remote areas may require vehicles to be transported considerable distances for repairs

Higher Repair Costs

When damage does occur, repairs to EVs often cost more due to:

- Specialized diagnostic equipment requirements

- Higher-priced replacement parts

- Increased labor costs for technicians with EV certification

- Complex integration of electrical and mechanical systems

5. Breakdown Coverage Differences

Roadside assistance for EVs involves unique considerations:

- Running out of charge: Unlike running out of fuel, an EV can't be quickly refilled at the roadside – it typically needs towing to a charging point

- Specialized towing: EVs often require flatbed towing to avoid damage to electric motors

- Charging point assistance: Some policies now include help with finding charging stations or assistance if you're stuck at a malfunctioning charging point

Many EV-specific insurance policies have adapted their roadside assistance offerings to address these scenarios, sometimes including emergency charging services or guaranteed towing to the nearest compatible charging station.

EV Insurance Pricing Factors Across Europe

While the factors mentioned above might suggest that EV insurance would be universally more expensive, the reality is more nuanced and varies significantly across European countries. Here's how EV insurance pricing compares to conventional vehicles in several key markets:

Countries Where EVs Often Have Lower Premiums

United Kingdom

In the UK, several major insurers including Aviva and Direct Line have reported that EVs are often cheaper to insure than combustion engine equivalents. This is attributed to:

- Statistical evidence that EV owners have fewer accidents

- Typically lower mileage driven by EV owners

- Strategic insurer positioning to capture the growing EV market

Denmark

Danish insurers have increasingly recognized EVs as presenting lower risks in several categories:

- Lower average speeds due to drivers' focus on efficiency

- Higher percentage of urban driving where accidents tend to be less severe

- Newer vehicles with advanced safety features

Netherlands

With one of Europe's most developed EV markets, Dutch insurers have accumulated substantial data showing:

- Lower-than-expected claim frequencies for EVs

- Strong correlation between EV ownership and safer driving behaviors

- Competitive market pressures leading to attractive EV premiums

Countries Where EVs Often Have Higher Premiums

Germany

In Germany, EV insurance typically runs 10-30% higher than comparable combustion vehicles due to:

- Conservative actuarial approaches given limited long-term data

- Higher average purchase prices of German EVs

- Higher repair costs in the German market

France

French insurers generally charge more for EV coverage, citing:

- Limited repair network outside major urban centers

- Higher parts replacement costs

- Longer repair times affecting courtesy car provisions

Italy

Italian insurance for EVs tends to be more expensive, reflecting:

- Less developed EV service infrastructure

- Higher cost of specialized parts imports

- Concerns about battery damage in extreme summer temperatures

EV-Specific Insurance Products in Europe

As the market evolves, many European insurers are creating tailored products for electric vehicle owners. Here are some noteworthy examples:

AXA's EV-Specific Policy

Available in several European markets including France, Germany and the UK, AXA's electric vehicle policy includes:

- Battery cover regardless of whether the battery is leased or owned

- Coverage for charging cables and wall boxes

- Emergency charging assistance if you run out of power

Allianz's Electric Vehicle Protection

Offered across multiple European countries, Allianz has developed coverage specifically addressing:

- Battery damage from both accidents and technical failures

- Home charging equipment protection

- Enhanced courtesy car provisions considering longer EV repair times

LV= Electric Car Insurance (UK)

This specialized policy includes:

- Recovery to the nearest charger if you run out of battery power

- Coverage for charging cables, wall boxes, and adaptors

- Alternative transportation specifically allowing for longer repair times

Government Incentives and Their Insurance Impact

Many European governments offer incentives for EV adoption that can also affect insurance considerations:

Reduced Tax and Registration Fees

Countries like Norway, Denmark, and the Netherlands offer significant tax advantages for EVs, which can offset higher insurance premiums. Some insurers also provide discounts aligned with these government incentives.

Charging Infrastructure Subsidies

Government support for home charging installation in countries like Germany and the UK can reduce the cost of equipment that needs to be insured.

Low Emission Zones

Cities like London, Paris, and Amsterdam have established low emission zones that provide operational advantages to EV owners. Some insurers factor these benefits into their pricing models, recognizing the reduced mileage in high-risk congested areas.

Tips for Finding the Best EV Insurance in Europe

If you're an EV owner or prospective buyer looking for insurance, consider these strategies:

1. Seek Specialist Providers

Look for insurers with specific EV experience and coverage options. These companies are more likely to:

- Understand the true risks and benefits of EV ownership

- Offer appropriate coverage for batteries and charging equipment

- Provide access to repair shops with EV certification

2. Check Battery Coverage Details

When evaluating policies, pay particular attention to:

- Whether battery damage is fully covered

- If there are exclusions for gradual battery degradation

- How battery leasing arrangements are handled (if applicable)

- Coverage limits specifically for the battery component

3. Consider Bundling Opportunities

Many insurers offer discounts when you bundle multiple policies. For EV owners, valuable combinations include:

- Auto and home insurance (particularly if you have a home charging station)

- Multiple vehicle policies if you have both EV and conventional vehicles

- Umbrella liability policies that can provide extended coverage for both your vehicle and charging infrastructure

4. Ask About Green Credentials Discounts

Some European insurers offer discounts to environmentally conscious consumers:

- Carbon-offset programs integrated with insurance policies

- Discounts for paperless billing and digital documentation

- Reduced rates for customers with multiple green lifestyle choices

The Future of EV Insurance in Europe

Looking ahead, several trends are likely to shape how electric vehicles are insured in Europe:

Data-Driven Pricing Models

EVs generate significantly more operational data than conventional vehicles. Future insurance models may utilize this data to offer:

- Usage-based insurance based on actual driving behaviors

- Predictive maintenance alerts that could prevent claims

- Real-time risk assessment and dynamic pricing

Battery Health Monitoring

As battery technology evolves, insurers may integrate battery health into their coverage models:

- Premiums reflecting the actual condition of the battery rather than just vehicle age

- Incentives for proper battery maintenance

- Coverage specifically tailored to battery degradation patterns

Integration with Smart Charging Networks

The growth of intelligent charging infrastructure may lead to insurance products that:

- Use charging data to assess vehicle usage patterns

- Offer discounts for using certified "insurance-approved" charging networks

- Provide integrated coverage for both vehicle and energy management systems

Conclusion

Electric vehicle insurance in Europe represents a rapidly evolving landscape where traditional auto insurance concepts are being adapted to meet the unique characteristics of this new technology. While some factors—like higher vehicle values and specialized repair needs—may increase premiums, others—like improved safety features and favorable driver demographics—often work to reduce costs.

The market varies significantly across European countries, with northern nations generally offering more favorable EV insurance terms than southern ones. This pattern largely follows EV adoption rates, suggesting that as markets mature, insurance offerings become more competitive and tailored to actual risk data rather than uncertainty premiums.

For current and prospective EV owners, the key is to seek out insurers with specific electric vehicle experience and to carefully compare coverage details, particularly for batteries and charging equipment. As the market continues to mature, we can expect increasingly sophisticated and data-driven insurance products that more precisely match the unique risk profile of electric mobility.

The transition to electric vehicles represents not just a change in propulsion technology, but an opportunity to rethink how vehicles are insured, with potential benefits for both consumers and insurers who adapt effectively to this new paradigm.