Planning to drive across Europe? Understanding the Green Card system is essential for ensuring you have proper insurance coverage throughout your journey. This guide explains everything you need to know about the International Motor Insurance Card System, commonly known as the Green Card system.

What is a Green Card?

A Green Card (International Motor Insurance Card) is an internationally recognized document that proves you have the minimum compulsory motor insurance required by the laws of the countries you're visiting. Despite its name, the Green Card is not always green—it can vary in color, though the traditional green color is still common.

The document serves as proof that your vehicle has at least the minimum third-party liability insurance coverage required in the country you're visiting. It's essentially a certificate recognized across borders that validates your insurance coverage when traveling internationally.

The History and Purpose of the Green Card System

The Green Card system was established in 1949 under the United Nations Economic Commission for Europe (UNECE). Its primary purpose was to facilitate the movement of vehicles across international borders by ensuring that victims of accidents involving foreign vehicles would be compensated according to the national laws of the country where the accident occurred.

Before this system, drivers had to purchase separate insurance policies at each border they crossed, which was both expensive and time-consuming. The Green Card system eliminated this need by creating a standardized document recognized by participating countries.

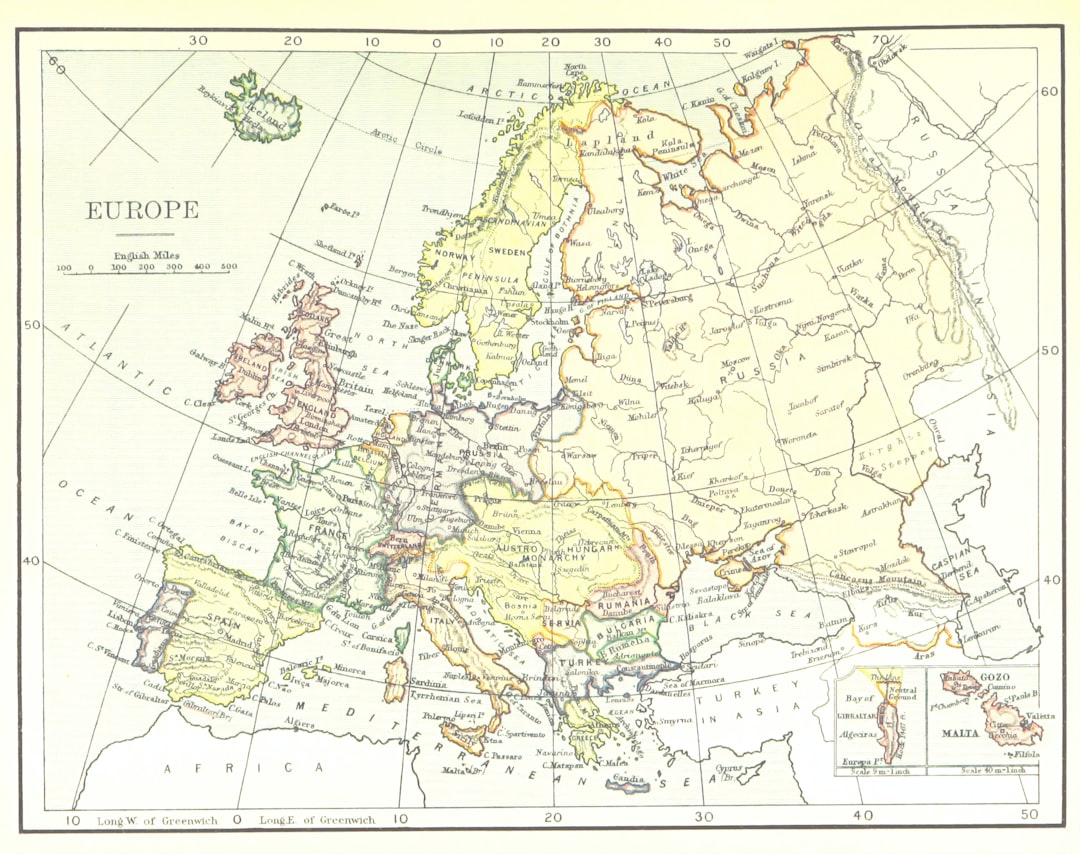

Countries Where the Green Card is Valid

The Green Card system currently includes 48 countries across Europe, parts of the Middle East, and parts of North Africa. These countries are divided into several zones.

Member Countries Include:

- All EU member states (including Denmark, Germany, France, Italy, etc.)

- European Economic Area (EEA) countries (Norway, Iceland, Liechtenstein)

- Other European countries (UK, Switzerland, Serbia, Russia, Ukraine, Turkey, etc.)

- Several Middle Eastern countries (Iran, Israel)

- North African countries (Morocco, Tunisia)

It's worth noting that since 2021, when the UK left the European Union, British drivers need a Green Card when driving in the EU and EEA countries, including Ireland.

When Do You Need a Green Card?

For EU/EEA Residents:

If you're a resident of an EU or EEA country (including Denmark), your regular motor insurance policy automatically provides the minimum cover required by law in other EU/EEA countries. This means you can drive throughout the EU, EEA, Switzerland, and now the UK without carrying a physical Green Card in most cases.

However, you might still need a Green Card in the following situations:

- When traveling to non-EU/EEA countries that are part of the Green Card system (e.g., Turkey, Russia, Morocco)

- If your insurance is set to expire during your trip

- If you're towing a trailer or caravan (some countries require a separate Green Card for trailers)

For Non-EU/EEA Residents:

If you're driving into the EU from a non-EU country (e.g., driving from the UK to France, or from Serbia to Hungary), you'll typically need a Green Card to prove you have valid insurance coverage.

How to Obtain a Green Card

Getting a Green Card is usually a straightforward process:

- Contact your insurance provider: Your current motor insurance company is the only entity that can issue you a Green Card. Contact them well before your trip (ideally 2-3 weeks in advance).

- Provide necessary information: Your insurer will typically need details about your vehicle, your policy, your travel dates, and the countries you plan to visit.

- Receive your document: In many cases, insurers can email you a PDF of your Green Card that you can print yourself. Some insurers might mail a physical copy or ask you to collect it from their office.

Most insurance companies provide Green Cards free of charge to their existing customers, though some might charge a small administrative fee.

Format and Validity

A standard Green Card includes the following information:

- The issuing bureau and insurance company details

- Policy number

- Vehicle registration number and type

- Validity period (start and end dates)

- Countries where the card is valid (typically indicated by country codes)

- Signatures of the insurer and policyholder

The validity period of a Green Card matches your underlying insurance policy but cannot exceed 12 months. If your insurance policy is renewed while you're abroad, you'll need to obtain a new Green Card.

As of July 2020, Green Cards can be printed on white paper and don't need to be on green paper anymore, making it more convenient for insurers to provide them electronically.

Coverage Provided by the Green Card

It's crucial to understand that a Green Card only proves you have the minimum third-party liability insurance required by the country you're visiting. This coverage typically includes:

- Damage to other people's property (e.g., their vehicle or building)

- Injury or death caused to other people

A Green Card does not provide:

- Damage to your own vehicle

- Personal injury coverage for you or your passengers

- Theft of your vehicle

- Any coverage beyond the minimum required by local law

Therefore, before traveling, it's advisable to check with your insurer whether your comprehensive coverage (if you have it) extends to foreign countries, and whether you need to purchase additional coverage for your trip.

What Happens If You Don't Have a Green Card?

If you're driving in a country where a Green Card is required and you don't have one, you may face several consequences:

- You might be denied entry at the border

- You could be fined

- You might be required to purchase temporary border insurance (which is typically more expensive than your regular insurance)

- Your vehicle could be impounded in extreme cases

Additionally, if you're involved in an accident without proper insurance documentation, you could face significant financial and legal complications.

Green Card and Brexit: Impact for UK and EU Drivers

After Brexit, the rules changed for drivers traveling between the UK and EU countries:

For UK Drivers Traveling to the EU:

From August 2021, UK drivers no longer need to carry a Green Card when driving in the EU, EEA, Andorra, Bosnia and Herzegovina, Serbia, or Switzerland. Your UK insurance policy provides the minimum coverage required.

For EU Drivers (Including Danish Drivers) Traveling to the UK:

Similarly, EU drivers no longer need a Green Card to drive in the UK. Your EU insurance automatically provides the minimum required coverage.

Tips for Danish Drivers Traveling in Europe

If you're a Danish resident planning to drive in other European countries, here are some helpful tips:

- Check with your insurer: Even though you may not need a physical Green Card for EU travel, it's still advisable to inform your insurance company about your travel plans.

- Consider extended coverage: The minimum third-party liability coverage might not be sufficient. Consider purchasing additional coverage for your vehicle and personal injuries.

- Verify coverage for non-EU destinations: If your journey includes countries like Turkey, Russia, or Morocco, you'll need to obtain a Green Card.

- Carry your insurance details: Even if a physical Green Card isn't required, always carry your insurance certificate and policy details.

- Check trailer requirements: Some countries require separate insurance documentation for trailers.

Conclusion

The Green Card system has significantly simplified cross-border driving in Europe and beyond by providing a standardized insurance verification system. While EU drivers enjoy the convenience of automatic minimum coverage throughout the EU and several other countries, it's always prudent to verify your specific insurance requirements before traveling, especially if your journey includes non-EU destinations.

Remember that the Green Card only provides proof of minimum liability coverage. For comprehensive protection during your international travels, consult with your insurance provider about extending your current coverage or purchasing additional protection for your trip.

With proper insurance documentation in hand, you can enjoy the freedom of exploring Europe by road with peace of mind, knowing you're protected wherever your journey takes you.